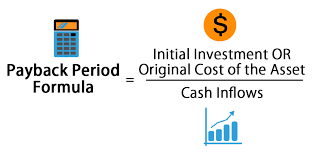

Payback period calculation formula

Calculate Net Cash Flow. Discounted Payback Period.

Undiscounted Payback Period Discounted Payback Period

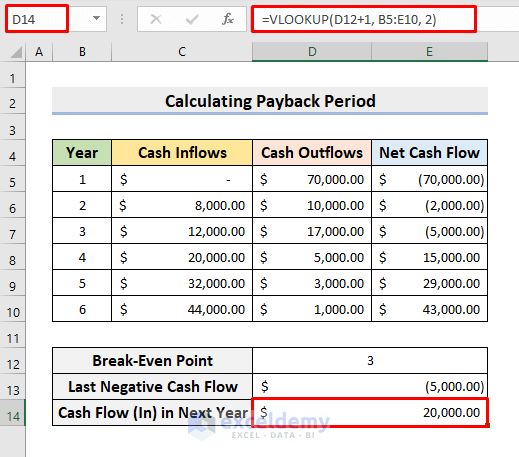

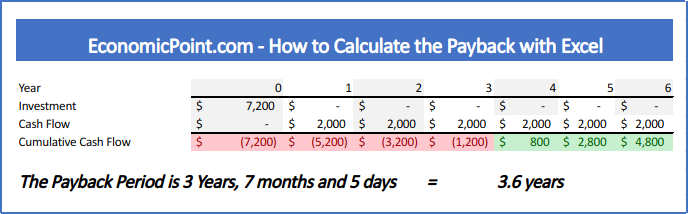

If your data contains both Cash Inflows and Cash Outflows calculate Net Cash flow or Cumulative Cash flow by.

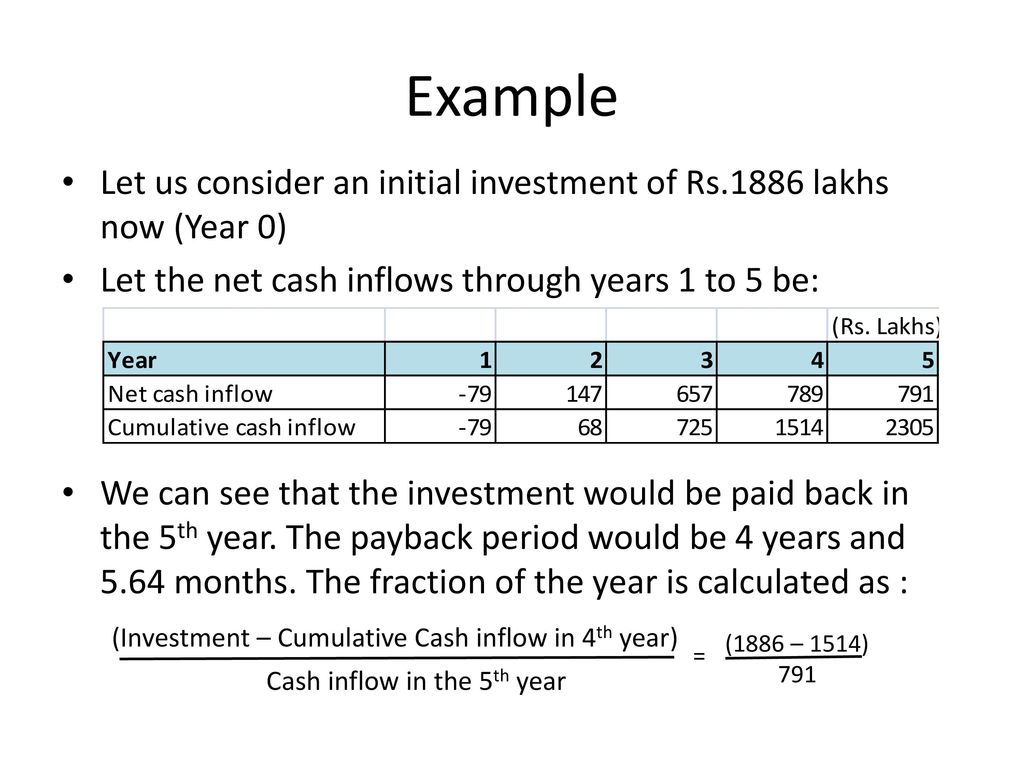

. By substituting the numbers into the formula you divide the cost of the investment 28120 by the annual net cash flow 7600 to determine the expected payback period of. For example imagine a company invests 200000 in. How to Calculate the Payback Period.

Investment Annual Net Cash Flow From Asset. Find Cash Flow in Next Year. Our discounted payback period calculator calculates the discount cash flow accurately and provides you with the complete cash flow in the form of table.

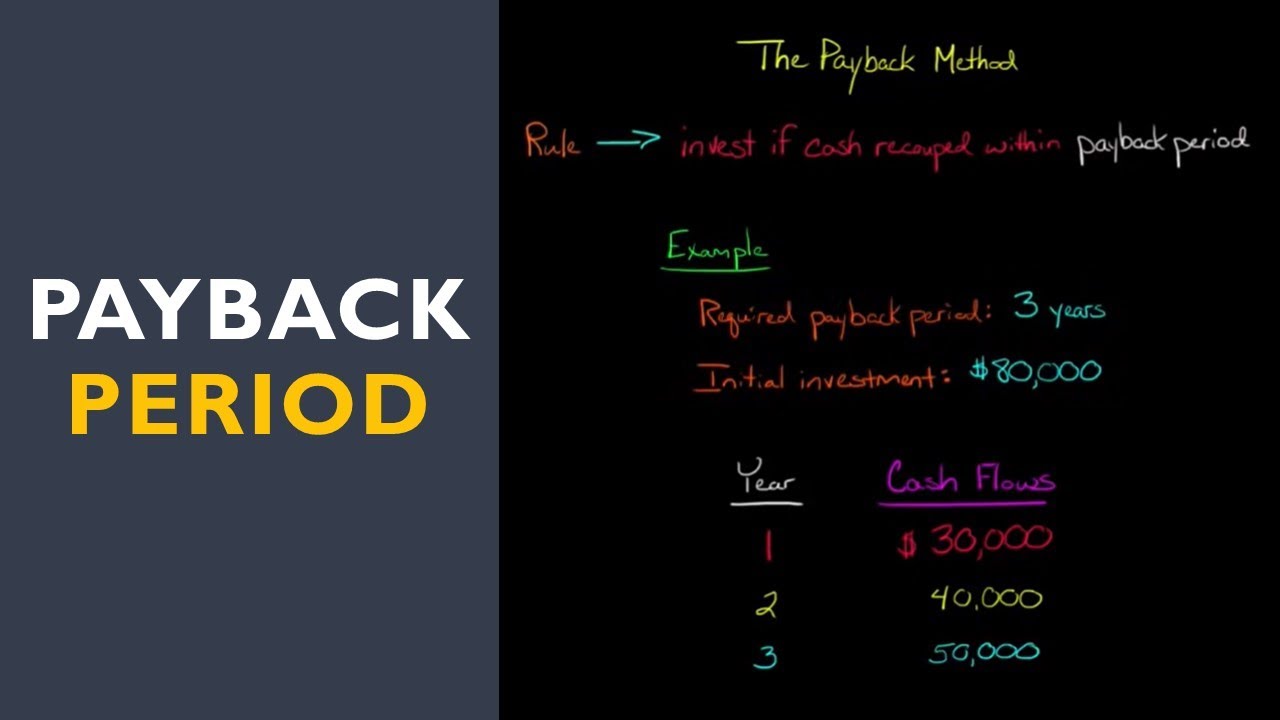

Payback Period Tutorial - Chapters0000 - Introduction0100 - What is Payback Period0240 - Payback Period Formula Calculation Equal cash flows0423 -. CAC MRR and ACS or MRR GM of Recurring Revenue Since I am using MRR the. As mentioned above Payback Period is nothing but the number of years it takes to recover the initial cash outlay invested in a particular project.

- ln 1 -. Payback Period Formula. Cash flow per year.

Retrieve Last Negative Cash Flow. Written out as a formula the payback period calculation could also look like this. As you can see using this payback period calculator.

The payback period calculation is simple. The formula for the calculations. Perhaps the simplest method for evaluating the feasibility of undertaking a potential investment or project the payback period is a fundamental capital.

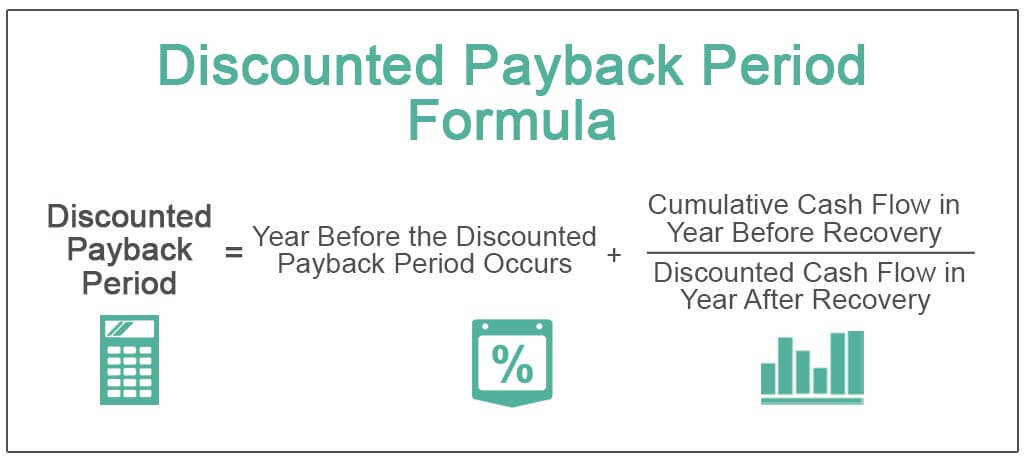

It can get a bit tricky when annual net cash flow is expected to vary from year to. Investment amount discount rate. Discounted Payback Period Year before the discounted payback period occurs Cumulative cash flow in year before.

The formula for discounted payback period is. Now we will calculate the cumulative discounted cash flows. To calculate the payback period you need.

Payback Period Initial Investment Annual Payback. Ln 1 discount rate The following is an example. The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows.

Step 2 Calculate the CAC Payback Period. Enter financial data in your Excel worksheet.

Calculate The Payback Period With This Formula

How To Calculate The Payback Period With Excel

Payback Period Formula And Calculator

Payback Period Summary And Forum 12manage

Payback Period Formula And Calculator

How To Calculate The Payback Period Youtube

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate The Payback Period With Excel

How To Calculate Payback Period In Excel With Easy Steps

Undiscounted Payback Period Discounted Payback Period

Calculating Payback Period Youtube

How To Calculate The Payback Period With Excel

Calculation Of Payback Period With Microsoft Excel Ppt Download

What Is Payback Period Formula Calculation Example

How To Calculate The Payback Period In Excel

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Discounted Payback Period Definition Formula Example Calculator Project Management Info